Binance FUD Explained

The last few days we've seen a lot of insecurity and uncertainty of the popular exchange and ecosystem Binance. You might not understand why, so I will give a quick explanation of what it all entails.

Where it started

So as most of us know, it all started with the collapse of FTX. We know FTX had struggles withdrawing large sums of money, which was initially explained as a liquidity crunch. To explain this in form of an example: Imagine handing someone $1000. They switch this to gold and store it for you. After some time, you ask for your $1000 back, and they will give it to you: they just need to grab the gold and trade it back for dollars. No problem; in this scenario $FTT tokens would be gold (which is already an issue by itself).

They asked CZ and Binance to help them out. But it was found out this was no matter of a liquidity crunch, this was insolvency. Using the example above, this means your 1000 dollars were actually not worth 1000 and your funds have been lost or used by the company for whichever reasons. FTX had allowed trading affiliate Alameda to borrow unlimited funds. Basically fraud, which had been happening for years. FTX understandably collapsed and filed for bankruptcy. Now people are left to wonder: if this happened to a big exchange like FTX, could any other exchanges also be insolvent?

Is binance insolvent?

To answer and tackle the question if binance is insolvent, we will have to look at different topics.

1 - The Mazars auditing firm

2 - The on-chain data

3 - CZ (Binance CEO) CNBC Interview

1 - The Mazars auditing firm.

Mazars is an international auditing firm. They’ve audited big platforms as Kucoin Crypto.com and Binance. Now recently Mazars Group has suspended all work with crypto comapanies and clients, which includes Binance. The decision to cut ties with Binance, KuCoin and Crypto.com comes just after the accounting firm released “proof of reserve” reports for several digital asset exchanges. Especially odd timing now exchanges are eager to proof their solvency to cover user’s withdrawals. Now, Mazars’ South African branch did published a five-page proof of reserves for Binance on Dec. 7, but has been deleted since Friday and had only accounted for Bitcoin. The report also didn’t show liabilities for Binance’s lending arm.

So binance wasn’t the only now, and accounting firms not wanting to work with crypto clients, especially in today’s climate, is totally understandable. But now, if this is the case, why aren’t other exchanges like coinbase receiving the same FUD? Well, on Dec. 9, Crypto.com published a proof of reserves audited by Mazars, attesting that customer assets were held on a 1-to-1 basis, meaning that all deposits were 100% backed by Crypto.com’s reserves.

2 - The On-Chain Data

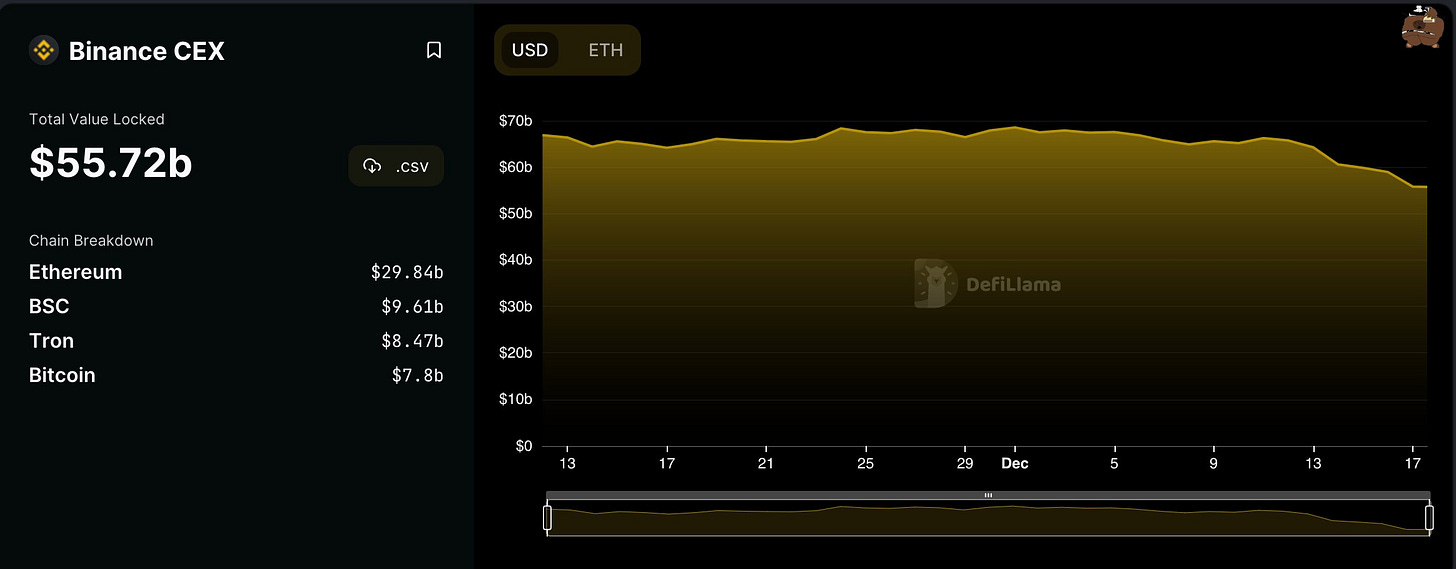

Now fact is that Binance currently has over $55 billion in their reserves based on on-chain data, verifiable on the blockchain. It seems then even, for lack of thought of better description, absolutely crazy to claim of a binance bank run if only a fraction of this has been withdrawn. Binancehas processed well over $14 billion in withdrawals this week alone according to on-chain data, with no issues.

Of course not as good as an official source but the Global Blockchain Lead at Ernst & Young (a Big 4 accounting firm) had a colleague test the initial Binance Proof of Reserves and says the numbers add up:

It's also worth noting that industry thought/data leaders like Coindesk, CryptoQuant, Nansen have attested to Binance's on-chain reserves. Some proofs of Binance’s reserves based on on-chain data:

3 - CZ interview on CNBC

If you’re active on twitter, you must’ve seen clips of CZ going on CNBC for an interview, talking about FTX and rumours of insolvency regarding his own exchange.

Many clips are going around and claiming Binance won’t get audited by the big 4 (Deloitte, Ernst & Young (EY), KPMG, and PricewaterhouseCoopers (PwC)). CZ claims they won’t because the big 4 don’t know how to audit crypto exchanges. But is this really reason enough to believe Binance must be insolvent? You could argue it more proves Binance might be hiding something and not pass their audits, but that’s all theorizing.

But let’s get facts straight, as these interviewees might’ve misunderstood CZ about the $2.1 billion FTT statement. It makes more sense to say his response about the $2.1 billion refers to funds Binance got for their FTX stake. It is not specifically about user funds or issuing withdrawals. This is why CZ keeps claiming that “Binance is financially strong”. People claim this statement is rather evasive to the question, but in light of the facts, CZ’s response on CNBC that “the lawyers will deal with it” if someone comes asking for the $2.1 billion FTX gave them, can be seen as reasonable.

So..

These are the facts and you can make up your own mind on Binance. In my personal opinion, I don’t think Binance is insolvent. They might be hiding some shady issues, but personally don’t think CZ would be so vocal and calling Sam Bankman-Fried (SBF, FTX owner) out so much if they were doing the exact same thing. Although, just take my opinion with a grain of salt.

We’ve also seen Kevin Oleary (Famous rich guy, also lost a lot of his investments in the FTX collapse but he’ll be fine) say that CZ has caused the FTX collapse. Which is bollocks. SBF has already been arrested and charged with eight counts of fraud, conspiracy, campaign finance law violations and money laundering.

So to now have tackled this viral list, you can make your own assumptions:

As for the $BUSD pointer: $BUSD is a stablecoin that’s not issued by Binance. $BUSD is issued by Paxos, backed by US dollars & T-bills, and approved AND regulated by the New York State Department of Financial Services (DFS).

And there we have it..

Hope you now have a better understanding of the recent FUD surrounding Binance!

You nailed every single point dude... 👊👍

Great one tbh it explained the happenings in detail in a simple way to understand. 🙌